T-mobile protection 360 tiers:

It can be argued that in the contemporary world, people cannot imagine their lives without a smartphone it is much more than just a device, it is a necessity. But what if one day the device fell into the hands of the aggressor, and was lost or damaged? This is where T-Mobile insurance comes into play, ensuring your device is safe and secure from the undesirable happenlife. From being a new user with a new phone to needing protection for the phone you already own, it is important to get to know about T-Mobile insurance.

What is T-Mobile Insurance?

T-Mobile Insurance is a brand of device protection service that is provided by T-Mobile in cooperation with Assurant. It’s intended to protect a smartphone or tablet against everything from accidental damage to theft, loss, and malfunctions that happen after the warranty has run out. Many options are available when it comes to the plans that customers can choose to get insurance for their T-Mobile-owned device.

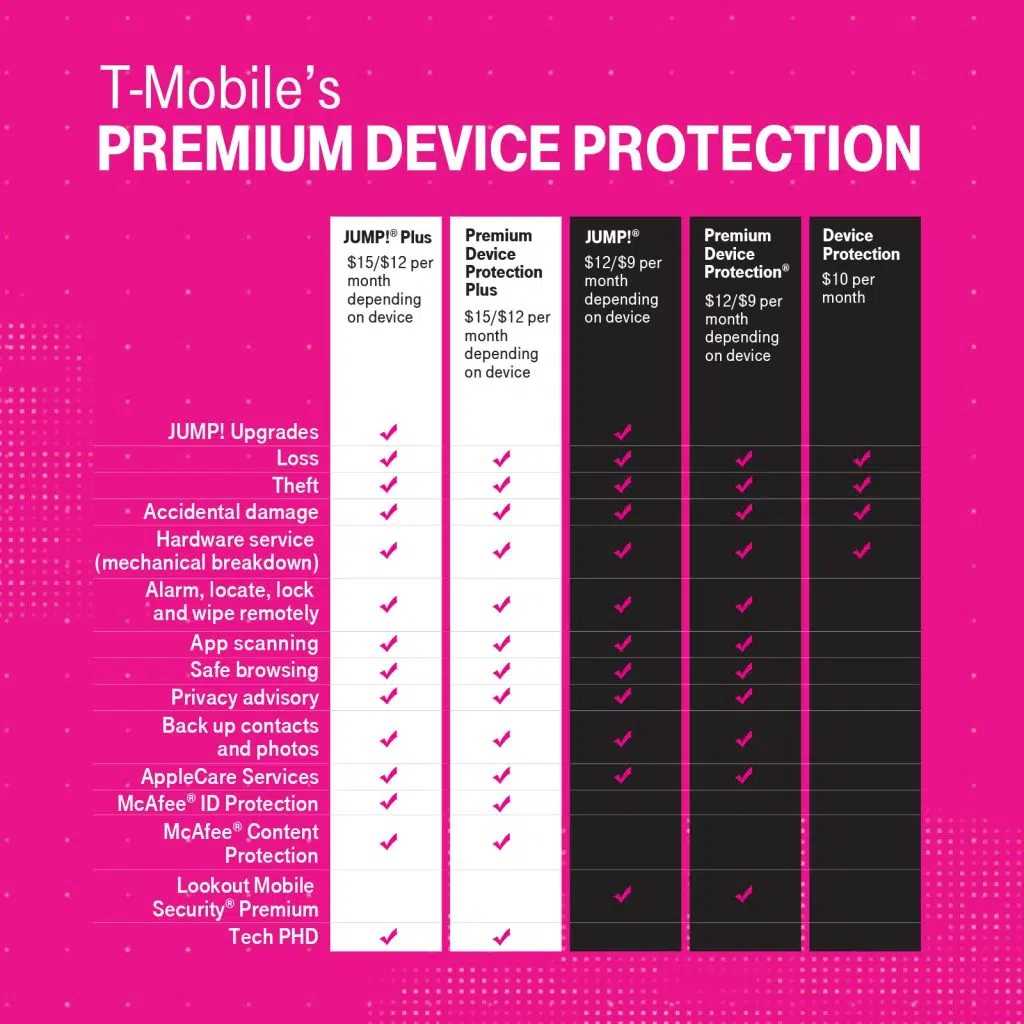

T-Mobile offers three primary protection plans: T-Mobile offers three primary protection plans:

- Protection<360>: Policies in this plan include accidental damage, loss or theft as well as hardware service on your device after your warranty has expired. This also has features like AppleCare Services for Apple, including accessories like multiple screen protector replacement and McAfee Security.

- Basic Device Protection: This plan deals with accidental damage, loss, and even theft, but it does not entail the extra features of Protection<360>.

- Premium Handset Protection (PHP): As with Basic Device Protection, this plan offers basic protection, but it can contain additional options based on the device and its place of use.

Why You Need T-Mobile Insurance

Getting mobile insurance is something that could help you reduce your time, money, and stress. It is a known fact that in one way or another, accidents occur and phones fall out of hands, get washed by water or sometimes you do get your phone snatched. The expense of mending or getting a new smartphone going up, you need T-Mobile insurance to ensure your smartphone is safe from expensive repairs.

One of the many benefits of taking up T-Mobile insurance is one gets to enjoy quick and easy repair or replacement services. This not only means costing you less money but also ensures that you are not ‘without’ your must-have device for long. Also, features like; T-Mobile’s insurance offer flexibility like free unlimited replacements for the screen protector, and enrollment to AppleCare for Apple products, which may not be present in other insurance products.

Types of Coverage Offered

Let’s take a closer look at the coverage options available with T-Mobile insurance: Let’s take a closer look at the coverage options available with T-Mobile insurance:

- Protection<360>: This plan is specifically designed for those who need the deepest level of protection, this covers Accidental Damage from Handling (ADHP) such as drops and spills, loss, theft, as well as post-warranty hardware breakdowns. Also, you are provided with AppleCare Services, unlimited replacements of screen protectors, and McAfee Security for T-Mobile devices.

- Basic Device Protection: Being more direct than the former, it embraces accidental damage, loss, or theft of a gadget. Although it does not come with the extra features of Protection<360> it offers basic car insurance cover at a cheaper price.

- Premium Handset Protection (PHP):: Like Basic Device Protection, this plan may include such extra features for your device and in your area, so it suites many customers.

Both plans have a monthly rate and when a claim is set to be made there are usually charges to be paid before the actual claim through the set deductible. Your deductible depends on your device and the type of claim: Get for a cracked screen or a new device claim, for instance.

How to Enroll in T-Mobile Insurance

As for T-Mobile insurance, quite simple to sign up for the program. That is, you can buy it when you are buying a device from T-Mobile or within a period after its purchase, which is often thirty days. Here’s how you can enroll: Here’s how you can enroll:

- At the time of purchase: If you purchase a new gadget from T-Mobile you’ll be presented with an offer of insurance for your device. Just click yes on the offer and go for the plan that you prefer the most.

- After purchase: If you did not purchase a T-Mobile insurance option when you originally bought your phone, there is still hope: you can enroll in the insurance program by going to a T-Mobile store, to the website of T-Mobile, or by dialing customer support number within the enrollment period.

- Important deadlines: Another important consideration is the time within which you can get to take up T-Mobile insurance after buying the device since failing to do so means that your device is not shielded.

How to File a Claim

Filing a claim with T-Mobile insurance is quite easy in case you are in a position to file for a claim. Here’s a step-by-step guide:

- Contact Assurant: You can either visit T-Mobile’s official website or contact the Assurant claim helpline to start the process.

- Provide necessary information: You will likely be asked for such things as your device’s IMEI number, a description of the event that happened, and a purchase receipt.

- Pay the deductible: If the claim is made based on certain events you will be expected to produce a deductible. This is not always the case and it is best that you ask for the price before going any further.

- Receive your repair or replacement: This will be the time when your claim will be approved and you get your device repaired or you are issued with a new one. At times, you receive a refurbished device when you make a complaint to the manufacturers or your service provider.

Pros and Cons of T-Mobile Insurance

If you are now thinking about utilizing the services of a T-Mobile insurance company, it is reasonable to know about the advantages and the disadvantages of doing so.

Pros:

- Comprehensive coverage options.

- Additional benefits such as the AppleCare Services and the McAfee security services.

- Filing of claims and fast processing of repairs or replacements.

- Endless returns of the screen protectors.

Cons:

- Regular monthly payments can cripple the budget with time.

- There are different Tier Options, and with it, the client is responsible for the payment of a deductible that may be expensive depending on the type of claim.

- Restrictions on the number of suits that one may institute in a given time frame.

- Is T-Mobile Insurance Worth It?

- The question ‘Is T-Mobile insurance worth it? ‘would only be answerable under the circumstances that befits an individual. Protection plans are useful if you have a new high-cost gadget or if you are clumsy and have a tendency to damage your gadgets. T-Mobile insurance has broad protection and extra facilities, which can help tremendously in the safeguarding of the equipment.

On the other hand, if you are cautious with your gadgets or you own an old model of the phone, you might see that having monthly premiums and deductibles greatly overshadow possible advantages. Fear not it is always wise to look at other alternatives, for example, third-party insurance or even an extended warranty to see which is best suited for you.

Other Similar Insurance Providers:

Here’s a table with some recommendations for similar insurance providers along with their websites:

| Insurance Provider | Coverage Details | Website |

|---|---|---|

| AppleCare+ | Covers accidental damage, includes Apple technical support, and hardware service. | AppleCare+ |

| Samsung Care+ | Offers coverage for accidental damage, loss, theft, and extended warranty services. | Samsung Care+ |

| SquareTrade | Provides protection against accidental damage, mechanical failures, and more. | SquareTrade |

| Asurion | Offers device protection plans including theft, loss, damage, and extended warranty. | Asurion |

| Geek Squad Protection | Available through Best Buy, covering accidental damage and mechanical breakdowns. | Geek Squad |

| Verizon Total Mobile Protection | Covers accidental damage, loss, theft, and post-warranty repairs. | Verizon Total Mobile Protection |

| AT&T Protect Advantage | Offers protection against accidental damage, loss, theft, and more. | AT&T Protect Advantage |

These providers offer various levels of protection, so it’s worth comparing them to find the best fit for your needs.

Conclusion

T-Mobile insurance: it is an important asset to have if one wants to safeguard his or her smartphone or tablet from life’s surprises. Convenientseveral plans can be selected in T-Mobile – so the company provides coverage possibilities that can be chosen depending on the person’s pocket and his/her demands. If you seek detailed coverage with additional options or for straightforward mobile insurance, T-Mobile insurance has got you covered. Analyze the risks, usage, and budget on the device to decide if T-Mobile Insurance will benefit the consumer.