Fire and Theft Insurance for Business:

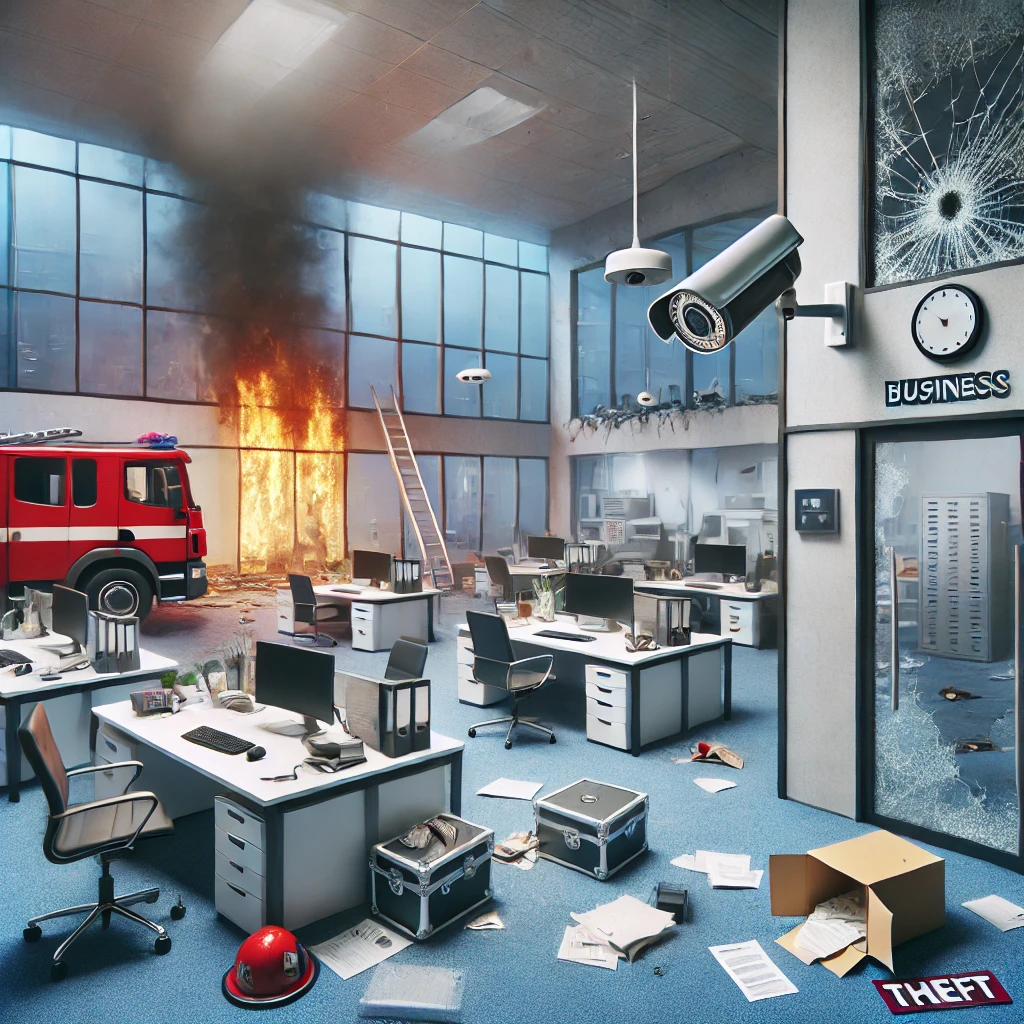

Business people have many responsibilities, and security begins with protecting their property and valuable items. Business owners experience many dangers, such as PEST risks which consist of physical process, elements and threats; fire and theft are among the frequent dangers among business owners. This is where fire and theft insurance for business comes in. In this article, the reader will learn what fire and theft insurance for business means, why this type of insurance is needed, how it operates, and which companies in the USA offer the greatest possibilities.

What is Business Fire and Theft Insurance?

Fire and theft insurance for business can be classified as a commercial insurance policy and is intended to cover a business from monetarily losses resulting from particular fire related events or from theft. This type of insurance covers loss in properties, equipment and stocks that result from any of these events.

Fire and theft insurance cannot be overemphasized for business because unexpected mishaps are always around the corner. Companies always risk facing this form of disaster, due to electrical mishaps, negligence, or even an act of God. Similarly, theft involves burglary, vandalism or real employees frauds and embezzlements. This policy help to protect your business from lost making big money and help your business to recover its self in case of such incidents.

Business fire and theft insurance often differ from one insurance company to the other or may have slight differences in the services provided depending on the services the business wants from the insurance firm. The most common items covered under such policies include:

- Physical property: This comprises the structure where business is being conducted, equipment, machinery and any other asset that the business owns but is not easily transportable.

- Inventory: It can also cover stock in trade and material that the business has purchased and has in stock such as the effects of fire or theft.

- Business interruption: There are some policies that pay for loss of business income in case of a fire or theft interrupting the business.

Business owners can choose their individual plans of fire and theft insurance for business policy. For example, a retail store will wish to cover more on stocks while a manufacturing plant will need to cover more of machinery and equipment.

FIRE AND THEFT INSURANCE FOR BUSINESS IMPORTANCE

There are several ideas why fire and theft insurance for business is important. Without it businesses can face serious monetary risks, this could mean the collapse of a business or that it becomes insolvent. Here’s why you should consider this type of insurance for your business:

1. Financial Protection

Fires and thefts are particularly dangerous in that they can cause a significant amount of loss and where the onus lies on the owner to make good the loss. Soft and hard business assets are protected financially with fire and theft insurance for business ; it would not cost individuals their valuable property to build another structure after mishaps.

For instance, fire in a small shop for sales of various items will lead to complete loss of goods and part of the structure. If there is fire and theft insurance for business then the insurance company would compensate for the loss of stock and even damages on the building. If this money were not covered under insurance, then the business owner is directly liable for it, which may easily lead to business failure.

2. Business Continuity

Such calamities like fire outbreaks, theft cases, etc. can tie your operations for days, weeks and sometimes months. The fire and theft insurance for business policy provide you with the necessary protection for your business to continue its operations. If the policy contains a business interruption clause, it pays you a sum for lost sales or revenues whilst you fix the physical losses or replenish your inventory.

Suppose there is a restaurant business and one day the kitchen catches fire, and the restaurant has to be shut down for about two months. At this stage they don’t make any earnings, but overheads which include rent and employee wages must be met. Business حذ تقوین This fire and theft insurance for business goods that business interruption coverage makes it possible for the restaurant to get reimbursed for the revenue it would have generated during the two months, hence sustenance of the restaurant’s operations.

3. Legal Compliance

Regardless of your field of activity and the office’s location, you may be obliged to maintain the fire and theft insurance for business. There are some states, or cities, where those who rent the property, may need to maintain an insurance policy of this kind, required by lease agreement that has to be signed with the company. Furthermore, companies in industries with higher risk must secure insurance in order to meet industry standards.

4. Protect Your Employees and Customers

Forced to deal with a fire or theft for example is not only the owner of the business but employees and even customers as well. Fire and theft insurance for your business means that you can continue making payments to employees and meet customer needs during a loss. This protection will help reassure everyone in your company and all your customers.

Each of these coverage options includes identification of the basic components of fire and theft insurance policies and comparison between the two.

The following are details of several things that you should consider when selecting business fire and theft insurance policy. The type of insurance policies that are present to your company are very specific to the insurance company and so that states why it is very important for one to consider the needs of the business when choosing an insurance policy.

1. Property Damage Coverage

Loss of properties is the basis of fire and theft insurance for business. This part of the policy covers non business personal property, for instance the physical structure of your business including the building, fixtures and machinery among others. It also provides for loss due to fire or theft in respect of properties in the building such as equipment, furniture and other.

For instance, if you have a fire mishap at your business house that burned down your computers and office furniture, then the property damage section will reimburse the amount of money you would use to replace them. This is particularly important where the firm has fixed assets such as machinery or valuables located in the facility.

2. Inventory and Stock Coverage

Those industries that stock large inventories are the most affected when there is fire outbreak or theft. Inventory and stock are also protected under fire and theft insurance for business policies; thereby, safeguarding you from loss should your business inventory get destroyed by fire or stolen.

For instance, a clothing store may well store over $ 1000 worth of merchandise in the stock room. This means that in case of fire and complete damage of all the merchandise exposed, loss is made good by the insurance through replacement of the clothing.

3. Loss of Income Coverage

Business interruption also referred to as gross income loss coverage pays for cash losses that occurred where the business cannot operate because of fire or theft among other events. This coverage is necessary because, even when your business is shuttered, there are still overhead costs – rent, salaries, and utilities, to name a few.

Supposing a fire Control act affects a bakery in a way that it takes six months to rebuild the building, and replace damaged equipment. Lost earnings coverage would help the bakery to be reimbursed the revenue would have earned during those six months and keep the owner going as the business comes back online.

4. Replacement Cost Vs Actual Cash Value

If your have had a loss and file a claim, the following are paid depending on what your policy offered – replacement cost or actual cash value.

- Replacement cost coverage: This type of coverage reimburses for the amount of money it would take to replace the property with new ones. For instance, if a fire occurred and burns a 5 year old oven to ashes, replacement cost coverage takes care of the cost of a brand new oven not the depreciated value of the old one.

- Actual cash value coverage: This form of coverage covers the value current rate of the damaged property in the market by offering its depreciation worth. Consequently, if the oven that was five years old was reduced to ashes in a fire, then, the actual cash value coverage would only get the owner a depreciated worth of the oven which could not be used to bring in a brand new oven.

Still, replacement cost coverage is more costly than actual cash value, and it is more favorable, as it guarantees that the owner can acquire new goods in cases of losses.

5. Additional Coverage Options

Apart from basic fire and theft insurance policy for business, there are other assets you may need to cover in case of a business mishap. Here are a few options to consider:

- Liability Coverage: In cases, where the event conveys fire or theft and leads to personal harm or property damage to the third party, liability coverage shields you from legal and legal activities.

- Debris Removal: Building must first be cleared, which may demand the service of contractors for the removal of debris after a fire. This coverage can help offset these expenses there is debris removal coverage.

- Equipment Breakdown Coverage: It assists in paying for repair or replacing of equipment in case the equipment has been destroyed by fire or stole.

- Electronic Data Coverage: If your business utilizes a lot of data to operate, including customer data, intellectual property, data coverage can go a long way towards paying for the recovery of the data after the event of a fire or theft.

Top Fire and Theft Insurance Companies in the USA

While choosing fire and theft insurance for business, it helps to tap into a provider who hires experts specializing in your business. Here’s a closer look at some of the top insurance companies offering fire and theft insurance for business in the USA:

1. The Hartford

The Hartford is amicable for the customization of base fire and theft insurance for business which serves different sectors. Their policies are property damage, business interruption and equipment breakdown. The Hartford also provides risk management services where the company ensures that its clients do not experience fire or thefts in the first place.

2. Nationwide

Nationwide is among the biggest and the oldest insurance companies in the United States of America. Their fire and theft insurance policies for business needs cover all facets including property and income loss. This company is well known for it excellent customer care and ability to work around a policy to fit a certain business.

3. Liberty Mutual

Fire and theft insurance is available to business enterprise by liberty mutual with a strong emphasis on risk management. Professionals offer risk descriptions to allow companies to know the loopholes that can lead to some losses in future. The policies of Liberty Mutual also embrace physical damage, loss of income and additional optional coverage.

4. Travelers

Travelers is one of the market leaders on the commercial insurance market, providing fire and theft insurance for business that contains property insurance as well as business interruption insurance and liability insurance. They boast of handling all the claims quickly and having excellent customer relations to help with all fire or theft situations.

5. Chubb

Chubb is a leading international insurance company providing wide range of commercial insurer products including fire and theft insurance for business. Their policies are quite favorite among big companies and are inclusive of broad coverage on property, equipment and inventory. Chubb also provides specific revenue coverage for various industries appearing to be at increased risk industries.

Contact info of the Mentioned Providers:

| Insurance Provider | Website |

|---|---|

| The Hartford | https://www.thehartford.com |

| Nationwide | https://www.nationwide.com |

| Liberty Mutual | https://www.libertymutual.com |

| Travelers | https://www.travelers.com |

| Chubb | https://www.chubb.com |

Conclusion

Business fire and theft insurance is an important aspect of any successful organization’s management plan. It offers the organizations a way of protecting themselves from two of the biggest and unpreventable risks in business. It ranges from protecting your tangible asset through loss of earnings guarantee which means that your business is protected against any loss in the event of a disaster.

The selection of this policy and the provider depends with the risk that the individual has therefore one must compare the risks and seek advice from the insurance experts. Fire and theft insurance for business is the kind of insurance that safeguards your investment as well as lets you relax and concentrate on the business.

FAQs

**1. What is Fire and theft insurance for business?

Fire and theft insurance for business mean compensation for physical damage to property, goods and business equipment due to fire or theft. They also comprise business interruption coverage.

**2. Approximately, is business interruption included in fire and theft insurance for business?

It depends on the policy. Several fire and theft insurance for business policies contain business interruption insurance policy, that pays for loss of income through the period the business shuts down due to the effects of fire or theft.

**3. What are the costs associated with fire and theft insurance for business?.

The insurance cost of fire and theft insurance for business depends on issues such as the size of the business, estimated value of the property and stock, coverage level, etc. Small business are likely to pay of their services ranging from $500 to $1500 per annum.

**4. What are my options on flexible options in my fire and theft insurance for business policy?

Indeed, but there are terms and conditions available for selection for buying fire and theft insurance for business. You may choose to add what is known as Named ends up being options such as liability, equipment break down, and electronic data preparation.

**5. What factors do I need to look for when selecting fire and theft insurance for my business?

When choosing the fire and theft insurance for the business, it is important to specified business value and the risks that may be experienced with the level of coverage required. There should also be the comparison of the policies of different providers in order to have the most suitable one for the business.